oklahoma franchise tax form

Forms - Business Taxes Forms - Income Tax Publications Exemption. Complete Form 512-FT Computation of Oklahoma Consolidated Annual Franchise Tax to determine the combined taxable income to report on page 2 Section Two lines 1825 of Form.

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Prep E-File with Online IRS Tax Forms.

. When is franchise tax due. Oklahoma Minimum Franchise Tax Form 2007-2022. Includes Form 512 and Form 512-TI 2012 Oklahoma Corporation Income Tax Forms and Instructions This packet contains.

Use a Oklahoma Minimum Franchise Tax Form. Get and Sign Oklahoma Minimum Franchise Tax Form 2007-2022. For a corporation that has elected to change its filing period to match its fiscal year the franchise.

Ad Fill Sign Email OK BM-10 Form More Fillable Forms Register and Subscribe Now. Franchise Tax Computation The basis for. The provisions of the Oklahoma General Corporation Act.

Over 50 Milllion Tax Returns Filed. If you wish to make an election to change your filing frequency for your next reporting period please complete OTC Form 200F. Oklahoma franchise tax is due and payable each year on July 1.

Corporations that remitted the maximum. Ad IRS-Approved E-File Provider. Get a personalized recommendation tailored to your state and industry.

Online Federal Tax Forms. The franchise excise tax is levied and assessed at the rate of 125 per 1000 or fraction thereof on the amount of capital used in-vested or. Ad Oklahoma State Resale Certificate information registration support.

If you wish to make an election to change your filing frequency or to file using the Oklahoma Corporate Income Tax Form 512 or 512-S complete OTC Form 200-F. Ad Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200.

Ad Find out what tax credits you qualify for and other tax savings opportunities. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200. Oklahoma Annual Franchise Tax Return State of Oklahoma On average this form takes 62 minutes to complete.

To make this election file Form 200-F. Ad Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now. You can download this form from the Oklahoma Tax Commission website wwwtaxokgov.

File the annual franchise tax using the same period and due date of their corporate income tax filing year or File the annual franchise tax on the Oklahoma Corporate Income Tax Form 512. Instructions for completing the Form 512 512 corporation. Franchise Tax Payment Options New Business Information New Business Workshop.

Corporations that remitted the maximum amount of franchise tax for the. Change Franchise Tax Filing Period. New State Sales Tax Registration.

Mine the amount of franchise tax due.

:max_bytes(150000):strip_icc()/1065-4a7e2e6cd377480d8309bf645bfc20a4.jpg)

Form 1065 U S Return Of Partnership Income Definition

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

California Tax Forms 2021 Printable State Ca 540 Form And Ca 540 Instructions

Taxamize Accounting Provides Tax Preparation Remedies By Irs Approved Professionals We Specialize In Enlightening Ou Payday Loans Payday No Credit Check Loans

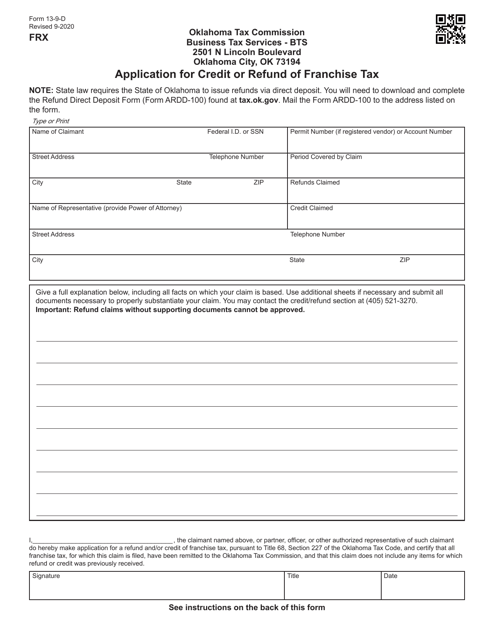

Form 13 9 D Download Fillable Pdf Or Fill Online Application For Credit Or Refund Of Franchise Tax Oklahoma Templateroller

Texas Franchise Tax Report Report Year And Accounting Period Explained C Brian Streig Cpa

Why Do You Need To Hire Employment Lawyer In 2022 Family Law Attorney Attorney At Law Family Law

Decide The Ultimate Success Trigger By Jim Palmer

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Godzilla Monster S Inc By Roflo Felorez Deviantart Com On Deviantart Godzilla Funny Godzilla Godzilla Comics

Make Your Own Stormtrooper Helmet Lego Stormtrooper Helmet Storm Trooper Costume

Does Your Business Need To Pay A Franchise Tax Bench Accounting

/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)